Laxmi Vilas Mittal - watch him & his life.

Third richest man after Bill and Warren

He is from a Middle class Rajasthani.

Learnt local medium.

Topped the school through out his education.

He started in Indonesia from a Holiday trip.

Lessons learned

1) Deferred success he consider it as a failure. ( Time is of high important man)

2) He says acquisition is of art more than a Science ( Heard this before from an I banker VP Merill Lynch though)

3) Believe in God and not in astrology ( Awesome)

4) He hire entrepreneurs to run the firm ( I think with a certificate in Entrepreneurship i have a good chance)

5) Acquisition is the way to grow ?? He says there is this many steel mills which we can make in a life time.

6) Only takes calculated risks.

7) Hate the word monopoly ( says consolidation)

What does money mean to him..

"Its the satisfaction for being some thing different and unique"

Business means

"Successful need not to be rich"

Mittal steel makes

"Ha ha no answer"

He still holds an Indian passport

"He says nothing distinguish from being a different nation"

India this much richer

"He says in India things would have been difficult if he stayed there"

Will his son follow him

"He says he will follow his son rather he following him"

Indian who made it at the top of the world today.

http://youtube.com/watch?v=VI5D-1Z2PBA

http://youtube.com/watch?v=w8mgH8v8qKg&mode=related&search=

http://youtube.com/watch?v=zijUvSphR0s&mode=related&search=

http://youtube.com/watch?v=kpOZOesTgmI&mode=related&search=

http://youtube.com/watch?v=_YjQPT6B0Ks&mode=related&search=

Thanks karthik for sending the link

Facts,

Sunday, February 11, 2007

L N Mittal lessons learnt

Posted by

Vijaychandran Veerachandran

at

8:13 AM

![]()

Labels: Facts, India, L N Mital, Lesson, London, Palace, Simi Garewal, Steel, Succes Story

Monday, November 27, 2006

Grahams value investing principles in a nutshell

Benjamin Grahams Value investing

The analytical criteria of the Graham-Rao method contain quality criteria and valuation criteria. The quality criteria are:

# The company must have an adequate size (Sales of Rs 100 crore may be taken as adequate size for Indian companies)

# Current assets should be at least twice that of current liabilities and the total debt-equity ratio should not be greater than 1:1

# The company should have paid dividends and earned profits for the last 10 years

# There should be a growth in earnings per share (EPS) of 10 per cent per annum over the last seven years The two valuation criteria are:

1.The current share price should not exceed 20 times the average EPS in the last seven years for companies with a seven-year growth (GAGR) higher than 20 per cent. For companies with past growth rate between 10 and 20 per cent per annum, the multiplier has to be the growth rate itself. In other words fair value is the average EPS of the last seven years multiplied by the P/E ratio specified as above

2.The current price should also not be more than 1.5 times the latest book value.

Posted by

Vijaychandran Veerachandran

at

7:29 AM

![]()

Labels: Benjamin Graham, India, Investing, Principles

Saturday, November 18, 2006

Indian entrepreneurship saga

Indians are the start-up kings of US. Indian immigrants to the US account for 28% of all foreign-founded private start-up companies in a climate dominated by immigrant entrepreneurs, according to a new study on the hot-button issue. The study found that over the last 15 years, immigrants have started one in four (25%) US public companies that were venture-backed, representing a market capitalisation of more than $500 billion

The study also found that immigrant founders are responsible for building a high percentage of the most innovative American companies, with 87% operating in sectors such as high-tech manufacturing, infotech and life sciences.

article is throws a light about Indian entrepreneur and the important part played in startups.

The surely could have mentioned some names like Ram Shriram, Vindh Khosla etc

Tuesday, November 07, 2006

Real Estate Sector review

I'm glad to have readers like Deepa who has some interesting insights and would like to know more about real estate sector. Here I make an attempt to understand the goings on

in the Real Estate sector and how and why it is a good investment option.

- The Tenth Five Year Plan has estimated a

shortfall of 22.4 million dwelling units in the country. According to

one estimate, over the next 10 to 15 years 80 to 90 million housing

units will have to be constructed. - The investment required for

constructing these dwelling units and for providing related

infrastructure during this period will be of the order of $666 billion

to $ 888 billion at roughly $33 billion to $44 billion per year ($ 1

billion = Rs 4,400 crore). - The real estate prices have stabilised and showing a steady growth after the boom and crash in the mid 1990s.

- There is a steady growth in Housing Finance sector of approx.30 % over last four years.

- The

rate of interest for housing finance has become reasonable and

affordable which has resulted into more credit offtake and subsequent

maturing of the housing industry. Even though there is an increase, the

rates are still reasonable to my mind after factoring in the tax

benefits. - Fiscal benefits provided by the Government of India have encouraged the end users and investors alike.

- Income of the urban buyer has grown substantially.

- There is tremendous scope and growth in the Infrastructure Development.

- Foreign investment by way of FDI has been approved.

- Emergence of professional builders in the market with proper accounting standards.

Emergence of rating systems for building projects. - The

high growth of the real estate sector has led a lager financial

institution to launch a dedicated real estate fund. These funds are

simultaneously enticing large institutional investors as well as High

Net worth Individual (HNIs) to expand their portfolio. - Last

year in July, 2005 SEBI approved the country’s first venture capital

fund, HDFC Property Fund, in real estate. Thus SEBI has not allowed to

a property fund to come up as a mutual fund but as a venture capital

fund. This will allow only the high net worth individuals and

corporates to subscribe for this fund. HDFC board had approved the

corporation’s entry into business of real estate venture fund after

SEBI amended, the venture fund act.

With the real estate prices of

both residential and industrial properties in major cities

sky-rocketing in the last two years and with housing still remaining a

major bottleneck for urban planners and developers, the bullish outlook

on the real estate market is justified. And many are projecting a 15-25% growth for the sector in the next 5 years. - A

report by the CII has pointed out that globally the real estate is and

should always be considered as an attractive investment option. - The

scrips in the construction sector are doing very well. The Mutual Funds

who have invested in Infrastructure stocks are doing well too. - Key Construction stocks to my mind are Gammon, GMR, Mahindra Gesco, Hind, Patel Engg., Era Constructions.

RBI

thinks the real estate sector is a bit heated up or prone to be over

heated. So there might be some go slow on Real Estate Mutual Funds and

Real Estate Investment Trusts (REIT) but they are bound to come, sooner

or later.

Posted by

Vijaychandran Veerachandran

at

8:17 AM

![]()

Labels: Five year plan, Housng units, India, Real estate

Monday, November 06, 2006

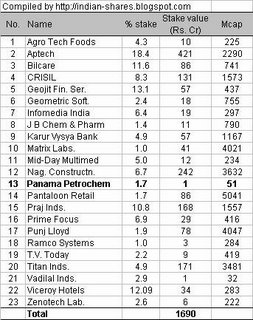

Rakesh Junjunwalas Portfolio

Note: Panama Petrochem Ltd is the new stock addition to the master investor's portfolio in September 2006 quarter. I shall shortly post more research on Panama Petrochem on this blog.

Disclaimer: Please dont invest just because he invested in it. The message got to me from an elite group which has key peoples working in indian stock exchange.

Posted by

Vijaychandran Veerachandran

at

6:12 AM

![]()

Labels: India, Investing, Junjunwala, Rakes, Stock market